According to Pew Research, renters headed roughly 36% of the nation's 122.8 million households in 2019, based on the latest reliable Census Bureau data. With such a large rental market, landlords can't afford to make mistakes with their rental property accounting. A few errors could lead to missed rental income, overspending on expenses, or failing to maximize tax savings.

When managing multiple properties, sloppy bookkeeping can easily cost you money, eroding your profits over time. Keeping your accounting in check is crucial to ensure your business stays profitable. Mastering rental property accounting means staying ahead of the game and avoiding costly financial slip-ups. Ready to take control of your property finances? Keep reading for practical tips to simplify your process and boost your bottom line.

Keep Accurate Records for Landlord Bookkeeping

Accurate record-keeping forms the backbone of efficient landlord bookkeeping. Without an organized system, tracking rental income, expenses, and taxes becomes a chaotic task that can lead to financial losses. Whether you manage one or multiple properties, it's essential to create a system that suits your needs, such as using accounting software designed for property management.

Start by separating your personal and rental accounts. Mixing them can complicate things and cause errors. Keep all records, including rent payments, receipts for repairs, and utility bills. With digital tools available, you can streamline this process and cut down on paperwork.

If you prefer manual tracking, establish a filing system that ensures easy access to important documents. A simple structure can keep you on top of your finances. Make sure to update your records frequently to avoid a backlog that can get overwhelming.

Here's how to stay organized:

- Use accounting software

- Separate accounts

- Track income weekly

- Categorize receipts

Consistent record-keeping prevents financial surprises during tax season. It helps identify areas where you may be overspending and keeps your business running smoothly. With everything organized, you'll have fewer issues during audits or tax filings, leading to a more stable financial outlook for your rental business.

Expense Tracking Tips for Efficient Rental Income Management

Tracking expenses is a key part of rental income management. Failing to track where your money goes can lead to budget mismanagement and, worse, missed deductions when filing taxes. Every cost, no matter how small, must be accounted for. By keeping detailed records of every purchase related to your property, you can manage cash flow more effectively.

Start by categorizing your expenses. This might include:

- Maintenance and repairs

- Insurance payments

- Utility costs

- Property management fees

Digital tools or apps can help you scan and store receipts quickly, eliminating the need for paper files. As you track expenses, set up a review process. Monthly or quarterly reviews allow you to compare spending patterns and make adjustments if necessary.

Maintaining a budget for each property ensures you stay in control of your spending. By doing this, you can plan for future repairs or upgrades without overspending.

Don't forget to monitor regular payments like insurance premiums or maintenance services, which are easy to overlook but can add up over time. These expenses directly impact your profits and need careful attention.

Property Tax Strategies for Maximizing Profitability

Understanding property tax strategies is essential for landlords in Jacksonville. Many property owners fail to maximize their deductions, missing out on significant savings. By keeping track of all deductible expenses, you can lower your tax liability and increase your bottom line.

First, familiarize yourself with Jacksonville's local tax laws. Working with a tax professional can help you identify all the deductions and credits that apply to your rental properties. Common deductible expenses include:

- Mortgage interest

- Property management fees

- Repairs and maintenance

- Insurance premiums

By applying these deductions, you can offset rental income and reduce your overall tax burden. It's also wise to keep track of capital improvements made to your property. These expenses can increase the property's value and may qualify for future tax breaks.

Setting aside money throughout the year for taxes ensures you aren't caught off guard when payment deadlines roll around. This can help avoid penalties and reduce stress when tax season arrives. Reviewing your tax strategy regularly with a professional can lead to additional savings, ensuring you maximize the return on your investments.

Smart tax planning puts more money back into your rental business. By implementing effective property tax strategies, you can grow your portfolio and increase profitability over time.

Set Clear Rent Collection Policies

Establishing clear rent collection policies is crucial for successful rental income management. A structured system ensures rent arrives on time, which directly impacts your cash flow. Whether you use an online payment platform or traditional methods, make sure tenants know the rules.

Automated systems can send reminders when rent is due, minimizing late payments. Consider offering incentives, such as small discounts for early payments, to encourage tenants to pay on time.

Clear communication is key; tenants should fully understand payment deadlines and any late fees involved. Consistent rent collection keeps your business financially stable.

Regular Financial Reporting for Landlords

Regular financial reporting rental is essential for staying on top of your property's performance. Monthly or quarterly reports offer insights into your income, expenses, and cash flow. You can quickly identify profit or loss trends, allowing you to adjust your strategy when needed.

Use simple spreadsheets or landlord-specific software to track key figures. Regularly reviewing these reports helps you stay informed and make smart financial decisions. Accurate reporting also ensures you meet tax obligations and avoid surprises. Financial transparency boosts your rental business' long-term success.

Mastering Rental Property Accounting

Mastering rental property accounting is essential for success in Jacksonville. Staying organized, tracking expenses, and managing income effectively can set you apart as a landlord. Understanding property tax strategies and focusing on financial reporting ensures your properties remain profitable.

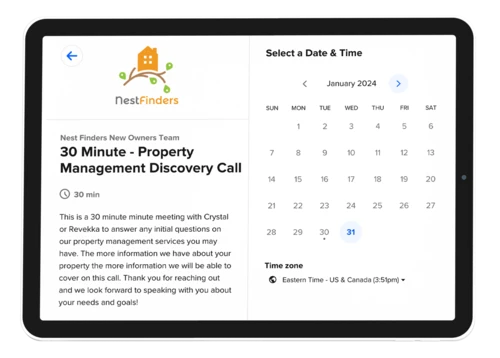

Looking for expert property management to grow your rental investment? Nest Finders, with over decades of experience, uses advanced resident screening and a proven marketing strategy to ensure your property is rented quickly by top-quality tenants. Contact us to maximize your investment and enjoy stress-free management backed by transparency and professionalism.